STA Meeting Nov 21 John Bollinger Fireside Chat with Jeff Boccaccio

Jeff Boccaccio's interview with the great John Bollinger for STA

Timestamps:

11:40 sudden discovery of the volatility of volatility

12:40 "open source" technicians, Mr Bollinger's gift to the world in open domain sharing

14:45 alternatives to StDev that were considered, and why StDev has magical qualities, including rapid adaptability

17:00 combining Keltner channels and Bollinger Bands as a market/sector conditions (dating to the late 80s, early 90s)

18:30 the problem/opportunity of gaps and the effects, and using exponential MA/StDev to avoid altogether

22:00 manually calculating bands for broad US indices and rescaling for relative comparisons

23:00 the beauty and power of Excel and Python ("Python should be the language of choice for technicians")

27:00 Rational analysis, a mixed methods blend of fundamental and technical analysis. "Closed minds don't work very well"

32:40 Skin in the Game and why having a background in trading is essential in the TA business

38:00 John's favorite uses of bands, and specifically BBs; how to define opportunities; defining estimates of reward:risk

39:40 fan of relative strength. market sector and component analysis' the importance of relative reward to risk estimation

41:15 Lazy W and a shout out to the Tortoise community of practice and our Kata 2,

42:15 :0:0:0 a shout out to our Tortoise methods and a deep connection to the Wycoff methods of classical TA!!! (just wow!)

43:40 some of John's favorite variations of BBs (including "typical price" rather than close)

45:00 the use of BB envelopes for non-standard windows for use with crypto and currencies, and idea of multiple sessions

51:00 "the more volatility the better"...we are trading volatility after all, and the anticipation of volatility!!!

52:10 Most people define Volatility as price action that goes against you :) small cap stocks that hit the news :)

53.20 loves crypto and their volatility, just stays with their cash markets

54:20 discussion of RS for use with crypto assets, the importance of choice of market and broker

55:20 multiple ways of using BBs to find tradeable markets and then to define opportunities within those markets

56:35 if he had to pick one, its mean reversion, because its mean reversion that is most robust (that's the essence of SSC and Kata2!!!)

57:40 large moves without volume, with price confirmation of reversion, is meat and potatoes )see Collapsing Dragon)

58:50 no magic bullet for picking the direction of a breakout from squeeze (our Z3P and Super-pinch)

59:30 people could save themselves a lot of money by keeping it simple and using bands

1:00:00 Most surprising use of BBs (for use outside of trading!!!)(not unlike quality control with stats and human safety)

1:02:20 New horizons for use of BBs; discusses socially responsible investing techniques & the problem of performance penalty

1:05:00 The use of RS performance overlays on markets, sectors, components: this is the essence of our BMR :)(been working for 20 yrs)

1:09:00 How JB thinks about constructing useful portfolios and baskets

1:11:00 On his experiences with predicting the ends of bull markets. "most bullish thing: gets overbought and stays that way"

1:14:00 Feelings of altitude sickness and what to do, while not being a "Perma-Bull"

1:15:00 Like football, we put the offense on the field when we have the ball, and play defense when we don't...learning to feel corrections

1:16:00 Looking for confirmations; Don't have to be right, you just cant stay wrong too long (as we say). follow the market

-

38:24

38:24

Tucker Carlson

6 hours agoTucker Carlson and Donald Trump Jr. Respond to the Trump Verdict

56.5K421 -

2:01:47

2:01:47

Fresh and Fit

7 hours agoAfter Hours w/ & Tommy Sotomayor

138K274 -

34:19

34:19

Alexis Wilkins

13 hours agoBetween the Headlines with Alexis Wilkins: The Verdict and More

37.2K26 -

1:11:21

1:11:21

Kim Iversen

13 hours agoWW3?!? Is The West Secretly Behind Another Color Revolution Aimed At Toppling Russia? | Biden Maniacally Bombs Yemen and Russia

82.7K61 -

1:36:46

1:36:46

Roseanne Barr

11 hours agoFor Love of Country with Tulsi Gabbard | The Roseanne Barr Podcast #50

93.2K152 -

33:59

33:59

TudorDixon

17 hours agoA Story of Sacrifice and Service with Joe Kent | The Tudor Dixon Podcast

33.5K4 -

27:22

27:22

The Nima Yamini Show

9 hours agoAlpha Nima Crushes Nick Fuentes & Business Tips with Dylan

32.2K20 -

1:19:23

1:19:23

Mally_Mouse

9 hours agoLet's Hang - Cosplay Stream!!

50.4K2 -

1:05:06

1:05:06

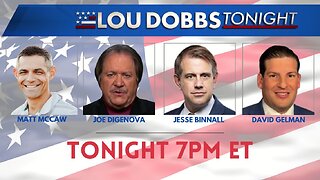

Lou Dobbs

15 hours agoLou Dobbs Tonight 5-31-2024

66.2K36 -

1:42:57

1:42:57

The Quartering

16 hours agoDonald Trump Conviction BACKFIRES, Massive Funds Raised, Democrats Swap Parties & More

102K98