The Future of the Dow: How to Forecast and Profit from Economic Changes

The Future of the Dow: How to Forecast and Profit from Economic Changes

The Dow Jones Industrial Average (DOW) is one of the most important stock market indices in the world. As such, understanding how it works and predicting its future movements can be extremely lucrative. In this blog post, we’ll take a look at the factors that influence the DOW, how to forecast its movements, and how to profit from economic changes. Photo by Karolina Grabowska on Pexels The Future of the Dow.

How to Forecast and Profit from Economic Changes.

Economic changes can have a big impact on the Dow Jones Industrial Average (DJIA). While it’s impossible to predict the future...

https://finetimer.site/the-future-of-the-dow-how-to-forecast-and-profit-from-economic-changes/

The Dow Jones Industrial Average (DOW) is one of the most important stock market indices in the world. As such, understanding how it works and predicting its future movements can be extremely lucrative. In this blog post, we’ll take a look at the factors that influence the DOW, how to forecast its movements, and how to profit from economic changes. Photo by Karolina Grabowska on Pexels The Future of the Dow.

How to Forecast and Profit from Economic Changes.

Economic changes can have a big impact on the Dow Jones Industrial Average (DJIA). While it’s impossible to predict the future with 100% accuracy, there are some steps investors can take to forecast economic changes and profit from them.

One way to forecast economic changes is by monitoring key indicators. Some important indicators to watch include gross domestic product (GDP), inflation, unemployment, and interest rates. By tracking these indicators, investors can get a sense of which direction the economy is moving in and make investment decisions accordingly.

Another way to profit from economic changes is by investing in companies that are likely to benefit from those changes. For example, if inflation is rising, companies that produce consumer goods may see their profits increase as consumers spend more money. Similarly, if interest rates are rising, banks may see their profits increase as people take out loans and invest in higher-yielding assets.

Of course, no one can predict the future with complete certainty. However, by monitoring key indicators and investing in companies that are likely to benefit from economic changes, investors can improve their chances of making profitable investments in the future.

Main point.

Point beneath it.

As the world economy continues to change and evolve, so too does the Dow Jones Industrial Average (DJIA). While it can be difficult to predict exactly how these changes will play out, there are some general trends that investors can watch for in order to make informed decisions about where to put their money.

One major trend that is likely to affect the DJIA in the coming years is the increasing global demand for energy. This demand is being driven by population growth and economic development in countries like China and India. As these countries continue to grow, they will need more and more energy to power their industries and homes. This increased demand will likely lead to higher oil prices, which will in turn have a positive impact on the DJIA. Energy stocks tend to do well when oil prices are high, so this is something that investors should keep an eye on.

Another trend that could have an impact on the DJIA is the continued rise of automation and artificial intelligence (AI). These technologies are making many traditional jobs obsolete, which could lead to increased unemployment and lower wages for workers around the world. This could have a negative impact on consumer spending and economic growth, which would ultimately drag down stock prices. However, it is worth noting that some sectors are actually benefitting from this trend. For example, companies that make robots or software for AI applications are seeing strong growth as businesses invest in these technologies. So while there may be some short-term pain for the economy as a whole, there could also be some long-term benefits for certain sectors.

Investors who are looking to profit from these trends should keep them in mind when making decisions about where to put their money. Energy stocks and companies that are benefiting from the rise of automation and AI are likely to be good bets in the coming years.

Main point.

Point beneath it.

In order to forecast and profit from economic changes, one must first understand...

-

5:29

5:29

FineTimer

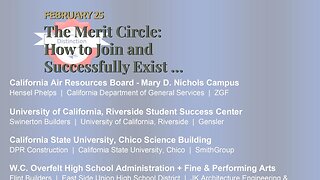

1 year agoThe Merit Circle: How to Join and Successfully Exist in this Competitive World

395 -

LIVE

LIVE

SNEAKO

4 hours agoSNEAKO X SPECIAL GUEST

7,159 watching -

LIVE

LIVE

Akademiks

7 hours agoDiddy Brutal Beatdown of Cassie Caught on Video Tape! Diddy Paid to Supress it, But it still LEAKED!

8,117 watching -

LIVE

LIVE

Right Side Broadcasting Network

3 days agoLIVE REPLAY: President Trump Keynotes Minnesota GOP Annual Dinner - 5/17/24

11,049 watching -

1:03:27

1:03:27

Talk Nerdy 2 Us

2 hours agoExposing Truths: Julian Assange's Battle and the TikTok Conspiracy

2.24K -

1:58:50

1:58:50

Laura Loomer

3 hours agoEP47: Georgia GOP Rocked With Anti-Trump Scandal Ahead of State RNC Convention

19.8K36 -

2:20:49

2:20:49

Roseanne Barr

5 hours agoWe finally got Ryan Long!!!! | The Roseanne Barr Podcast #48

47.8K69 -

1:01:06

1:01:06

The StoneZONE with Roger Stone

6 hours agoWill Terrorists Take Down America's Power Grid? With Glenn Rhoades | The StoneZONE w/ Roger Stone

28.9K22 -

1:03:58

1:03:58

Edge of Wonder

7 hours agoAce Ventura: Mandela Detective, King Charles Portrait & Weird News

31.4K44 -

1:40:05

1:40:05

The Quartering

11 hours agoWhy Modern Women Suck w/Hoe_Math

47.1K29