Hacked: How Algorithms Are Driving Stock Price Changes and Costing You Money!

Hacked: How Algorithms Are Driving Stock Price Changes and Costing You Money!

As the world’s most popular podcast, you would think that we would have better understanding of how algorithms are impacting stock prices and costing companies money. Alas, that is not the case. In fact, there is evidence to suggest that algorithms are driving stock prices changes and costing companies millions of dollars each year! Use this information to your advantage as a business owner or investor—and don’t be surprised if your stock price falls in the process! Photo by Tima Miroshnichenko on Pexels How Algorithms Impact the Stock Market.

Algorithmic trading is a type of Trading that uses algorithms to...

https://finetimer.site/hacked-how-algorithms-are-driving-stock-price-changes-and-costing-you-money/

As the world’s most popular podcast, you would think that we would have better understanding of how algorithms are impacting stock prices and costing companies money. Alas, that is not the case. In fact, there is evidence to suggest that algorithms are driving stock prices changes and costing companies millions of dollars each year! Use this information to your advantage as a business owner or investor—and don’t be surprised if your stock price falls in the process! Photo by Tima Miroshnichenko on Pexels How Algorithms Impact the Stock Market.

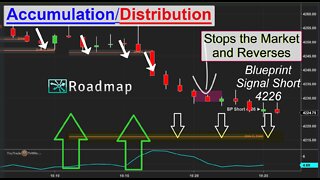

Algorithmic trading is a type of Trading that uses algorithms to make trades. Algorithmic trading can be expensive because it uses complex methods that are not subject to human error. This can lead to systematic errors in the trader’s decision-making, which can cause prices to change abruptly and unpredictably.

How Algorithmic Trading Cost You Money.

Algorithmic trading can cost you money in a variety of ways. For example, if you’re using an algorithm to trade stocks, you could lose money if the stock price goes down while the algorithm is still profitable, but also if the stock price goes up while the algorithm is no longer profitable. In other words, your losses could depend on how the market swings during your trade (positive or negative).

The Solution to Avoid algorithmic trading costs.

There are several ways to avoid algorithmic trading costs:

– Use a stop loss order before starting a trade;

– Make sure your data is accurate;

– Abide by rules set by exchanges or financial regulators; and

– Use human traders instead of algorithmically traded stocks.

The Impact of Algorithmic Trading on the Stock Market.

Algorithmic trading is the use of computer programs to predict stock prices. This can be done in a number of ways, but the most common algorithm is called a “ robots” program. Algorithmic trading can have a significant impact on the stock market by driving up and down prices.

The main effects of algorithmic trading are:

– It can cause stocks to trade at higher or lower prices than they would otherwise;

– It can cause shares to sell at a lower or higher price than their true value; and

– It can lead to stock market bubbles and crashes.

Tips for Safely Investing in the Stock Market.

First and foremost, understand what algorithmic trading is. Algorithmic trading is a type of trading that uses algorithms to make stock prices changes. The goal of algorithmic trading is to achieve a specific result by manipulating the data in order to achieve a different one. This can be done through various methods such as buying and selling stocks, setting stop-loss orders, or using macroeconomic indicators.

Be Aware of the Risks of Algorithmic Trading.

Many people don’t realize the risks associated with algorithmic trading until it goes wrong. Many times, this occurs when someone makes an investment that they didn’t expect to have success with because their algorithm was incorrect. Additionally, there are also risks associated with algorithmic trading if you do not have enough knowledge about it. For example, if you’re not familiar with how technology works and your algorithm produces incorrect results, you could lose money.

Be Prepared for The Impact of Algorithmic Trading.

If you do experience any negative effects from algorithmically-generated stock prices changes, be prepared for them! One way to reduce these costs is by being aware of potential consequences and preparing for them in advance. Additionally, try to find resources like online calculators or books that can help you understand more about algorithms and how they work before making any investments.

Algorithmic trading has a significant impact o...

-

9:59

9:59

DayTradeToWin

2 years agoPrice Action Live Market Manipulation - Trading Software and Filtering Techniques☑️

23 -

9:35

9:35

Matt Kohrs

1 year agoStock Market Manipulation

3.01K5 -

2:58

2:58

Muathe.com

1 year ago $0.01 earned🔴 How Traders Can Take Advantage Of Big Swings In Technical Analysis (Secret Hack) #Crypto #Stocks

59 -

9:48

9:48

EricKrownCrypto

1 year agoBitcoin Price Is Being Manipulated Today

551 -

7:39

7:39

DayTradeToWin

1 year agoFight Back Against Trading Manipulation

7 -

6:24

6:24

DayTradeToWin

2 years agoUsing Market Manipulation to Your Benefit ✳️traders Need to Learn This Strategy

59 -

31:26

31:26

We Profit with Stock Curry

9 months agoTrading Psychology | Why 75% of Traders Lose Money

8021 -

12:01

12:01

DayTradeToWin

2 years agoAttn Traders - Market Manipulation Exists - How Will You Trade

10 -

8:35

8:35

LargePetrol

3 months agoBREAKING: The Untold Story of XDC! 💎 Smart Money Analysis Predicts EXPLOSIVE Gains! 📈"

471 -

8:57

8:57

Algo Factory

1 month agoAre Investors LEAVING BITCOIN at the Halving??? BTC Price Prediction

59