Top 5 Stocks Eating Off ChatGPT, OpenAI

OpenAI introduced ChatGPT on November 30, and since then, it has demonstrated its ability to perform a variety of jobs, including writing stock stories, layoff emails, and even messages for dating apps. It is an illustration of generative AI, which is educated on enormous amounts of data and may produce text-based or even visual responses. Like any new fancy toy, the need to replicate and monetize is booming and many tech companies are scrambling to be the next best thing in the market. So who stands to gain the most for the next generation in tech and will this help resurrect a an ailing sector? Lets find out in today’s episode of Money Talk Sundayz.

Subscribe: https://linktr.ee/moneytalksundayz

Welcome to Money Talk Sundayz. I'm your host Stevie Bee. For those tuning in via your favorite streaming platform hit that like and share button. You can also subscribe to the Money Talk Sundayz podcast. The link will be in the description box. For those viewing on YouTube, like, share, and subscribe. You can even hit the notification bell to receive the alerts of new videos dropping.

The rumor mill has gone into overdrive, and Microsoft is reportedly investing $10 billion in OpenAI. OpenAI is not listed on open markets, but public stocks related to artificial intelligence have been benefiting from the trend.

ChatGPT, the lazy man’s key to adequacy is here and everyone is catching the buzz. Since the phenom burst into the public eye, copycats have been popping up left and right clamoring for a piece of the pie.

It goes without saying that some of these imitators will be more successful than others. Others still will try to expand on the capabilities of this AI and make it more all-encompassing. One thing they have in common is the parts under the hood that they will need to get the engine running. It is for this reason, these 5 stocks are making major moves in the market currently.

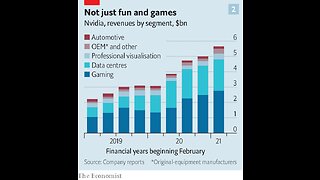

Nvidia

The artificial intelligence mania is ingrained in Nvidia, which is best known for designing and manufacturing graphics processing chips. The company's technology is used for numerous AI integrations, from self-driving vehicles to robotics.

Jensen Huang, the company's creator and CEO, has become significantly wealthier as a result of the Nvidia stock boom; according to Bloomberg data, his worth has increased by more than $5 billion so far this year.

Also optimistic is Wall Street. According to recent estimates from Citigroup analysts, a surge in ChatGPT usage may result in $3 billion to $11 billion in sales for Nvidia over the course of the next year. According to the bank, Nvidia's ChatGPT might be a significant computational demand driver.

Nvidia's new chips, according to Wells Fargo and Bank of America analysts, are positioned to benefit from the increased compute demands of ChatGPT and other generative AI tools.

Ambarella

Another chip manufacturer that caters to the AI sector is Ambarella. It creates semiconductors for use in anything from cellphones to in-car entertainment systems.

Also, it specializes in "system on a chip" semiconductors, which enable artificial intelligence computing by fusing several core processors onto a single logic board.

Ambarella chips are utilized in autonomous driving systems, and the company recently collaborated with Continental, a German auto supplier, on an autonomous driving project.

Mobileye

Intel created Mobileye as a spinoff company that specializes in semiconductors and cameras for driver assistance and self-driving vehicles. Among its clients are GM, Ford, and VW. The company's SuperVision system is designed to be nearly entirely autonomous, and its Chauffeur product is intended to turn a car into a Level 4 self-driven vehicle.

The corporation announced a positive sales outlook for 2023 after exceeding quarterly expectations. CEO Amnon Shashua bragged about bookings of almost $17 billion that go all the way until 2030.

On a conference call with analysts, he stated, "We expect SuperVision to be a very substantial growth driver in 2023 and beyond."

C3.ai

The popularity of ChatGPT has helped C3.ai, a provider of artificial intelligence software, see a recent increase in stock price. On recent announcement that it would incorporate ChatGPT into its product lineup, shares increased by about 61%.

The most cutting-edge models, like ChatGPT and GPT-3, as well as the most recent AI capabilities from organizations like Open AI, Google, and academia are all integrated into the C3 Generative AI Product Suite, according to a news statement from C3.ai.

Alteryx

The software from Alteryx is well recognized for data and analytics, and the company is also committed to advancing automation. The company specializes on integrating artificial intelligence, albeit on a smaller scale than competitors like Google and Meta.

"Continuing success with large businesses helped Alteryx post a strong fourth quarter with annual recurring revenue (ARR) growth of 31% over the prior year. We ended the year on a high note and saw an increase in operating profitability "said Mark Anderson, the company's CEO. With improved sales and customer success activities, a broader array of services, including our extremely distinctive end-to-end Alteryx Analytics Cloud platform, we have a wonderful opportunity as we head into 2023 to continue to generate significant outcomes for our clients.

Revenue for the fourth quarter of 2022 was $301.1 million, an increase of 73%, compared to revenue of $173.8 million in the fourth quarter of 2021.

Are you already riding the wave?

-

7:46

7:46

Best Product Reviews

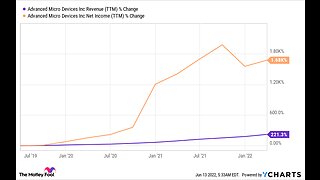

11 months ago5 Super Semiconductor Stocks to Buy Hand Over Fist for the AI Revolution - The Motley Fool

25 -

7:23

7:23

Best Product Reviews

1 year agoNvidia is not the only firm cashing in on the AI gold rush - The Economist

46 -

7:16

7:16

Best Product Reviews

10 months agoThe Best AI Stock to Own Could Be Sitting in Your Pocket - The Motley Fool

1031 -

7:01

7:01

Best Product Reviews

11 months agoInflection AI, Year-Old Startup Behind Chatbot Pi, Raises $1.3 Billion - Forbes

96 -

7:29

7:29

Best Product Reviews

1 year agoInvesting in AI: how to avoid the hype - Reuters

58 -

6:45

6:45

Best Product Reviews

10 months agoMissed Out on the AI Rally? My Best AI Stock to Buy and Hold (Even Now) - The Motley Fool

1091 -

0:49

0:49

Lark Davis

11 months agoTop 5 AI Stocks

1 -

7:11

7:11

Best Product Reviews

11 months agoInside China's underground market for high-end Nvidia AI chips - Reuters

98 -

6:29

6:29

Best Product Reviews

1 year agoNvidia's results spark nearly $300 billion rally in AI stocks - Reuters

29 -

7:07

7:07

Best Product Reviews

1 year ago70% of Companies Will Use AI by 2030 -- 2 of the Best AI Stocks Investors Can Buy Now - The Mot...

55