Accounting Equation - Urdu/Hindi - Get Ahead in Cambridge Accounting 7707 / 9706 with Easy Tips

1. The Complete Guide to Cambridge Accounting 7707 and 9706 for O Levels A Levels!

2. The Secret to Getting Great Grades in Cambridge Accounting 7707 and 9706!

3. How to Ace Cambridge Accounting 7707 and 9706 in Just One Month!

4. The Most Comprehensive Guide to Cambridge Accounting 7707 and 9706!

5. Get Ahead in Cambridge Accounting 7707 and 9706 with These Easy Tips!

Follow our Channel:

https://www.facebook.com/GRITuptodate

@grituptodate4591

https://www.febspot.com/ref/371435

BUSINESS ENTITY CONCEPT:

According to this concept, the business is considered as a separate business entity from its owner(s). Thus the financial information of the business will be recorded and reported separately from its owner’s personal financial information.

CONDITIONS FOR CONSIDERING A MONETARY EVENT AS “TRANSACTION”

1. There must be Two Parties Involved

2. The event must be Measurable in Terms of Money.

3. The Event must result in Transfer of Property and Service.

4. The events must Change the Financial Position of the Business.

MAKING OF ACCOUNTS AND DOUBLE ENTRY SYSTEM:

Instead of constantly drawing up balance sheets after each transaction what we have instead is Double Entry System.

DOUBLE ENTRY:

Double entry is the fundamental concept underlying present-day bookkeeping and accounting. Double-entry accounting is based on the fact that every financial transaction has equal and opposite effects in at least two different accounts. It is used to satisfy the equation Assets = Liabilities + Equity, in which each entry is recorded to maintain the relationship.

BREAKING DOWN 'DOUBLE ENTRY':

In the double-entry system, transactions are recorded in terms of debits and credits. Since a debit in one account will be offset by a credit in another account, the sum of all debits must therefore be exactly equal to the sum of all credits. The double-entry system of bookkeeping or accounting makes it easier to prepare accurate financial statements directly from the books of account and detect errors.

-

20:13

20:13

Financial Mathematics

9 months agoFinancial Mathematics November 2022 Q6.2-6.3 Grade 12 Mathematics

420 -

8:30

8:30

Financial Mathematics

9 months agoFinancial Mathematics November 2022 Q6.1 Grade 12 Mathematics Revision

429 -

25:40

25:40

Financial Mathematics

10 months agoFinancial Mathematics November 2021 Grade 12 Mathematics Revision

435 -

9:06

9:06

Financial Mathematics

10 months agoFinancial Mathematics November 2008 Grade 12 Mathematics Revision

444 -

8:10

8:10

Financial Mathematics

10 months agoFinancial Mathematics November 2020 Grade 12 Mathematics Revision

432 -

1:41

1:41

Sherman Academy

9 months agoWhat are the Accounting Principles?

72 -

3:02:33

3:02:33

Realistic Logical Ideologist

1 year agoStudy Session 35: Accounting - I love Accounting

2 -

2:11

2:11

GRE Practice

3 years agoAppropriate Calculation Correction: Practice GRE with a Cambridge PhD

10 -

2:56

2:56

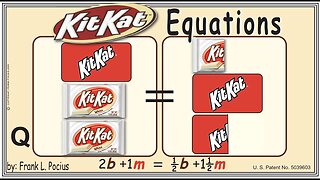

FrankPocius

1 year agoQ1_vis KITKAT WHITE 2b+1m=0.5b+1.5m _ SOLVING BASIC EQUATIONS _ SOLVING BASIC WORD PROBLEMS

1 -

2:30

2:30

Sherman Academy

9 months agoWhy is Accounting Important?

77