HOW TO TRADE BITCOIN THE RIGHT WAY WITH CHARTS! #bitcoin #crypto #stockmarket

FREE DISCORD - https://discord.gg/nasdaq-trades-crypto-stock-market-sqqq-tqqq-qqq-1031042061589282837

#nasdaq #stockmarket #crypto

Disclaimer:The content of all videos produced by this channel are for educational purposes only. All ideas, opinions and/or forecasts are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the stock market. Any investments made in light of these ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk. I am not an investment advisor, videos are for educational purposes only and not a recommendation to buy or sell any stock, ETF or futures contract at any time. This channel and its publishers are not liable for any investment decisions made by its viewers or subscribers, all videos are for educational purposes only. The author of this video does express certain opinions in the contents of this video, but will not assume any responsibility for the actions of any viewer who acts on this educational information. The author of this video may or may not hold positions in the financial instruments discussed in this video.Trading involves a high level of risk. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future performance. Consult an investment professional before investing.

What Is Bitcoin?

Bitcoin is a decentralized digital currency that you can buy, sell and exchange directly, without an intermediary like a bank. Bitcoin’s creator, Satoshi Nakamoto, originally described the need for “an electronic payment system based on cryptographic proof instead of trust.”

Every Bitcoin transaction that’s ever been made exists on a public ledger accessible to everyone, making transactions hard to reverse and difficult to fake. That’s by design: Core to their decentralized nature, Bitcoins aren’t backed by the government or any issuing institution, and there’s nothing to guarantee their value besides the proof baked in the heart of the system.

“The reason why it’s worth money is simply that we, as people, decided it has value—same as gold,” says Anton Mozgovoy, co-founder & CEO of digital financial service company Holyheld.

Since its public launch in 2009, Bitcoin has risen dramatically in value. Although it once sold for under $150 per coin, as of June 8, 1 BTC equals around $30,200. Because its supply is limited to 21 million coins, many expect its price to only keep rising as time goes on, especially as more large institutional investors begin treating it as a sort of digital gold to hedge against market volatility and inflation. Currently, there are more than 19 million coins in circulation.

Bitcoin is built on a distributed digital record called a blockchain. As the name implies, blockchain is a linked body of data, made up of units called blocks containing information about each transaction, including date and time, total value, buyer and seller, and a unique identifying code for each exchange. Entries are strung together in chronological order, creating a digital chain of blocks.

“Once a block is added to the blockchain, it becomes accessible to anyone who wishes to view it, acting as a public ledger of cryptocurrency transactions,” says Stacey Harris, consultant for Pelicoin, a network of cryptocurrency ATMs.

Blockchain is decentralized, which means it’s not controlled by any one organization. “It’s like a Google Doc that anyone can work on,” says Buchi Okoro, CEO and co-founder of African cryptocurrency exchange Quidax. “Nobody owns it, but anyone who has a link can contribute to it. And as different people update it, your copy also gets updated.”

While the idea that anyone can edit the blockchain might sound risky, it’s actually what makes Bitcoin trustworthy and secure. For a transaction block to be added to the Bitcoin blockchain, it must be verified by the majority of all Bitcoin holders, and the unique codes used to recognize users’ wallets and transactions must conform to the right encryption pattern.

These codes are long, random numbers, making them incredibly difficult to produce fraudulently. The level of statistical randomness in blockchain verification codes, which are needed for every transaction, greatly reduces the risk anyone can make fraudulent Bitcoin transactions.

-

6:25

6:25

Website with WordPress

1 year agoThe Best Guide To BitcoinInvest (BTV) Price, Charts, Market

17 -

2:43

2:43

Crypto Sweet Spot

1 year agoThe smart Trick of Cryptocurrency Market — TradingView That Nobody is Talking About

11 -

7:07

7:07

Website with WordPress

1 year ago5 Easy Facts About BitcoinInvest (BTV) Price, Charts, Market Shown

3 -

8:35

8:35

Website with WordPress

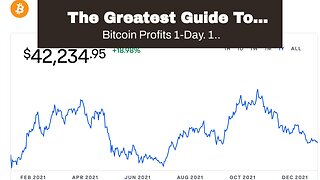

1 year agoThe Greatest Guide To BitcoinInvest Price Today btvusd Stock Value Chart

11 -

8:50

8:50

Website with WordPress

1 year agoThe Greatest Guide To BitcoinInvest Price Today btvusd Stock Value Chart

19 -

6:42

6:42

NakedTrader - Price Action - #Stocks - #Bitcoin - not your financial advisor

3 months ago $0.02 earnedATH for Bitcoin 2 days in a row | NakedTrader

89 -

49:22

49:22

The SPX Investing Program

2 years ago $0.02 earnedFree Stock Market Course Part 14: Cryptocurrencies

1733 -

13:01

13:01

BriefCrypto

1 year agoBitcoin Price, Crypto Market, Crypto News , Crypto Cycles, BTC ETH ADA BOTTOM?

27 -

2:43

2:43

Crypto Sweet Spot

1 year agoCryptocurrency Trading, Get Prices and Buy - eToro Can Be Fun For Anyone

6 -

2:34

2:34

Crypto Sweet Spot

1 year agoCryptocurrency Market — TradingView Fundamentals Explained

34