Arkansas Public Employees Retirement System Faces Overpayment Issue

Introduction

The Arkansas Public Employees Retirement System (APERS) recently made headlines when it was discovered that retirement benefits had been paid to a deceased member for more than seven years. This oversight resulted in ineligible payments totaling approximately $133,500. The incident raises questions about the system's internal processes and highlights the need for improved measures to prevent such errors in the future.

The Overpayment Issue

According to a report by the Arkansas Legislative Audit, APERS routinely experiences overpayments of retirement benefits for one to two months due to its payment schedule. However, auditors discovered two significant cases of overpayment during their examination of the system.

In the first instance, retirement benefits were paid to a deceased member for over seven years after their passing. The system was made aware of the member's death in 2017, but the monthly payments continued until August 2022. To rectify the situation, APERS has reached a repayment agreement with an individual associated with the deceased member. The repayment plan involves an initial payment of $5,000, followed by monthly payments of $250 at 0% interest. At this rate, it will take nearly 43 years to fully recover the overpaid amount.

In the second case, a member received an overpayment of approximately $72,500 due to an error in changing the benefit option correctly. The system continued to pay the member benefits under the straight-life option instead of the reduced annuity option with survivor benefits, as requested in the member's application. To address this, APERS will reduce the member's monthly annuity by $1,350 until January 2027 to recoup the overpaid amount.

System Improvements and Future Considerations

APERS has acknowledged the need to improve its internal processes to prevent similar incidents in the future. The system now requires multiple employees to verify death audit reports and ensure accurate entry of death dates into the system. Additionally, they are implementing a new procedure for death notification, generating system notifications when proof of death is submitted. These measures aim to halt payments promptly upon the death of a member.

Lawmakers have raised concerns about the adequacy of current state laws in handling such cases. Some suggested looking into how other states have addressed similar issues and considering whether tighter regulations are necessary. The Arkansas Teacher Retirement System had previously faced similar challenges with overpayments to deceased members, emphasizing the importance of proactive measures to prevent such errors.

Conclusion

The overpayment issue at the Arkansas Public Employees Retirement System highlights the need for robust internal processes and vigilance in managing retirement benefits. While APERS has taken steps to rectify the situation and improve its procedures, it is crucial for the system to learn from this incident and implement measures to prevent future overpayments.

As retirees and beneficiaries rely on these systems for their financial security, it is imperative that retirement systems prioritize accuracy and accountability. By leveraging technology, implementing stringent verification processes, and strengthening collaboration with relevant agencies, retirement systems can ensure that benefits are appropriately disbursed and that funds are not paid in error, thereby safeguarding the integrity of the system and the financial well-being of its members.

-

5:40

5:40

LLVClips

3 years agoHow to solve Illinois's financial and pension problems

32 -

2:37

2:37

KMGH

6 years agoColorado pension program uncertainty causing angst among teachers, other public employees

1 -

2:15

2:15

WTVF

7 years agoMaury County School Employees Face Another Payroll Problem

6 -

0:27

0:27

WSYM

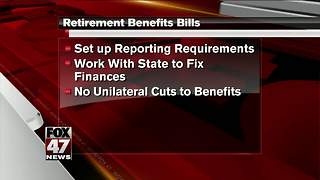

6 years agoLegislature approves municipal retirement funding bills

-

3:46

3:46

The Last Capitalist in Chicago

7 months ago $0.06 earnedBeneficiary forms can override your will

245 -

2:51

2:51

KNXV

3 years agoState agency overpaid $20.2 million in unemployment in 7 months in Arizona

121 -

3:21

3:21

GetPayroll

2 years agoEMPLOYEE TIME TRACKING: Lessons in Payroll with Charles Read

31 -

1:48

1:48

KSHB

3 years agoUnemployment overpayment continues to cause problems for Missouri claimants

27 -

2:09

2:09

KSHB

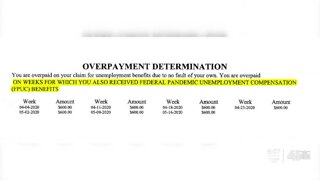

4 years agoKansas Department of Labor addresses problem with FPUC payments

41 -

10:58

10:58

bishoponair

1 year agoHow are bank failures impacting Illinois public employee pension funds?

4