Missed Out on the AI Rally? My Best AI Stock to Buy and Hold (Even Now) - The Motley Fool

🥇 Bonuses, Promotions, and the Best Online Casino Reviews you can trust: https://bit.ly/BigFunCasinoGame

Missed Out on the AI Rally? My Best AI Stock to Buy and Hold (Even Now) - The Motley Fool

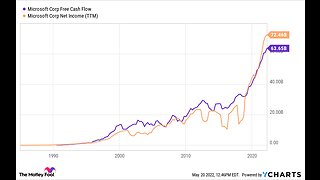

Are you kicking yourself for not buying Nvidia last fall? Did you miss out on ChatGPT mania this spring? Well, fear not. Artificial intelligence (AI) and the potential for companies to benefit from it is here to stay, as are the stocks behind it. In fact, we're still in the early stages of the AI stock era. For instance, even with all the hype surrounding AI technology at the moment, there's one company out there that remains significantly undervalued as it relates to its AI-connected potential. That stock is Tesla (TSLA -0.50%) and here's why (even now) is a great buy-and-hold candidate. Image source: Getty Images. Let's be clear: Tesla is an AI company Ask the general public and most who know of its existence would say Tesla is a vehicle manufacturer, first and foremost. They would be right in that regard because roughly $5 of every $6 Tesla generates in revenue comes from electric vehicle (EV) sales. But that fact describes the current situation at Tesla. What about the future? It's in those projections that Tesla's AI pipeline looks far more promising. Technologies such as full self-driving (FSD) and robo-taxis remain out of reach at the moment. Despite CEO Elon Musk's repeated assurances that FSD is right around the corner, challenges remain. But once FSD is up and running, it will utterly transform what it means to own a Tesla. In much the same way that owning an iPhone wouldn't be the same if there was no internet, owning a Tesla that can drive itself (and perhaps generate revenue for its owner) will be a game-changer for the company. It's this potential that explains part of why Cathie Wood and her Ark Invest investment firm have set a $2,000-by-2028 stock price target on Tesla. Wood understands that each vehicle sold today isn't just revenue on Tesla's income statement; it's another piece in an eventual platform that should help Tesla generate significant revenue from future services related to FSD or similar AI-supported services. What's more, the research and development (RD) Tesla is putting into FSD today could pay off in surprising ways. For example, Tesla recently signed deals with competitors like General Motors and Ford Motor Company , permitting owners of their non-Tesla vehicles to buy an adapter and use Tesla's existing (and vast) network of charging stations. A few years down the road, a similar process could play out with Tesla selling access to its FSD software to competitors in exchange for a fee. That would make the company's services segment -- currently less than 10% of overall revenue -- a far more important business. Rising production leads the way to AI growth To make Tesla's AI plans a reality, the company needs more of its vehicles on the road. And that's already happening. Tesla recently announced second-quarter production numbers that beat analysts' expectations: 480,000 vehicles were delivered to owners, up 85% from 259,000 a year ago. That figure easily topped the consensus Wall Street estimate of 445,000. The rising production numbers mean that Tesla will have plenty of its cars on the road in the coming years. So that when (not if) FSD comes to fruition, the company can roll out software updates at scale to millions of its vehicles. Granted, Tesla's AI advancements are incomplete, and regulatory challenges will crop up as the company gets closer to achieving FSD status. But the EV maker should have science on its side. Tesla claims its own research indicates that its autopilot technology is already statistically safer than human drivers. And a recent trip to Italy left me thinking that many roads (I'm looking at you, Rome) would be safer and less chaotic with the introduction of computer-aided driving. In the end, FSD will come to pass. Consider how legacy vehicle-safety technology -- like seat belts, airbags, and cruise control -- has now become commonplace. Once FSD crosses from the theoretical to the practical, Tesla will add a powerhouse AI business to its already impressive EV business. And that's why Tesla is one of the best AI stocks to buy and hold right now. Jake Lerch has positions in Ford Motor Company, Nvidia, and Tesla. The Motley Fool has positions in and recommends Nvidia and Tesla. The Motley Fool recommends General Motors and recommends the following options:...

-

7:16

7:16

Best Product Reviews

11 months agoThe Best AI Stock to Own Could Be Sitting in Your Pocket - The Motley Fool

1031 -

7:12

7:12

Best Product Reviews

11 months ago3 AI Stocks to Buy Now and Hold Forever - The Motley Fool

23 -

7:32

7:32

LumleyTrading

1 year ago$MULN Stock Analysis - DON'T BUY MULLEN

27 -

28:05

28:05

Matt Wolfe Archive Channel

7 months agoAI News: What You Might Have Missed!

43 -

46:38

46:38

BeachBum Trading

1 year agoIs AA a Stock to Buy Now?

72 -

24:52

24:52

Matt Wolfe Archive Channel

7 months agoActually Big AI News Week - Here's What You Missed

67 -

17:34

17:34

BeachBum Trading

1 year agoAIRI - Air Industries Group - Is AIRI a Stock to Buy Now?

551 -

7:05

7:05

NakedTrader - Price Action - #Stocks - #Bitcoin - not your financial advisor

9 months ago $0.01 earnedRivian Automotive stock analysis - RIVN September | NakedTrader

301 -

8:11

8:11

Money Talk Sundayz

1 year agoTop 5 Stocks Eating Off ChatGPT, OpenAI

58 -

1:01:01

1:01:01

Martyn Lucas Investor

7 months ago $0.04 earnedUBER Stock Earnings - TRADING & INVESTING - Martyn Lucas Investor

1641