See This Report about "Understanding the Factors Affecting Gold Rates for Savvy Investors"

https://rebrand.ly/Goldco3

Get More Info Now

See This Report about "Understanding the Factors Affecting Gold Rates for Savvy Investors", gold rate investing

Goldco aids customers shield their retired life savings by rolling over their existing IRA, 401(k), 403(b) or various other professional retirement account to a Gold IRA. ... To find out exactly how safe haven rare-earth elements can aid you construct and also secure your wide range, as well as also secure your retired life phone call today gold rate investing.

Goldco is just one of the premier Precious Metals IRA business in the United States. Secure your wealth as well as resources with physical rare-earth elements like gold ...gold rate investing.

Committing in gold has long been thought about a secure and reputable assets technique. With its ability to preserve riches and function as a bush against rising cost of living, it's no marvel that several capitalists are attracted to this valuable steel. However, creating informed selections when spending in gold rates is critical to make certain excellence in this market.

To start with, it's necessary to understand the factors that determine gold costs. Gold costs are influenced by numerous economic and geopolitical aspects such as passion rates, inflation, money variations, and political irregularity. Keeping an eye on these elements can help investors create better-informed choices.

One of the essential elements to take into consideration when putting in in gold prices is rate of interest prices. Gold usually tends to execute properly when passion rates are reduced or dropping. This is because low-interest fees lower the chance price of keeping non-yielding resources like gold. On the various other hand, climbing interest costs can easily make various other expenditures a lot more appealing compared to gold, leading to a decrease in its demand and cost.

Inflation is an additional vital variable that affects gold costs. Traditionally, gold has been thought about an helpful hedge versus rising cost of living. When rising cost of living climbs, the investment energy of fiat unit of currencies declines, helping make entrepreneurs switch in the direction of resources like gold to protect their wide range. Therefore, tracking rising cost of living trends can offer useful understandings in to potential gold rate movements.

Unit of currency changes also participate in a significant function in determining gold costs. As gold is priced in US dollars globally, any kind of changes in the worth of the buck can affect its price. A strong dollar often leads to decrease gold prices as it helps make it more expensive for purchasers using other unit of currencies. On the other hand, a feeble buck tends to press up demand for gold and consequently enhance its rate.

Political irregularity and geopolitical pressures likewise possess an effect on the cost of gold. Throughout times of anxiety or crisis, entrepreneurs often seek safe-haven possessions like gold as a shop of worth. This enhanced demand drives up its cost substantially.

Right now that we have discussed some crucial variables influencing gold costs, allow's delve in to how investors can easily make informed decisions when spending in this priceless metallic.

First and foremost, it is crucial to conduct in depth research study and remain upgraded along with the latest headlines and market trends. This includes tracking financial clues, geopolitical events, and main financial institution plans that can easily influence gold costs. By staying notified, financiers may foresee prospective rate activities and help make prompt expenditure decisions.

Furthermore ,, variation is crucial when spending in gold rates. While gold can easily be a dependable expenditure, it is constantly smart to have a well-diversified profile that features various other resources such as inventories, connects, and true property. Diversification helps disperse risk and lessens the effect of any type of individual possession's performance on the total collection.

Moreover, understanding the different forms of gold expenditures is necessary for helping make informed choices. Capitalists can select to spend in physical gold by means of gold bars or pieces or decide for paper-based financial investments like Exchange Traded Funds (ETFs) or futures arrangements. Each expenditure form has its very own advantages and risks that need to be thought about prior...

-

5:06

5:06

Website with WordPress

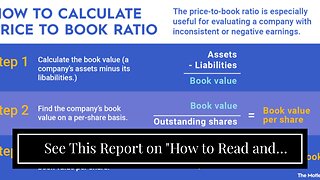

1 year agoSee This Report on "How to Read and Interpret Gold Rates: A Beginner's Guide to Investing"

26 -

6:39

6:39

Website with WordPress

1 year ago"5 Tips for Successful Gold Rate Investing" Fundamentals Explained

8 -

25:09

25:09

Midas Gold Group

10 months agoThe Mentality of Owning Gold | The Gold Standard 2329

174 -

1:26

1:26

Gold & Silver Central

11 months agoGold PRICE Vs Gold VALUE (Explained)

27 -

2:41

2:41

Scottsdale Bullion & Coin

7 months agoSafe-Haven Demand Drives Gold Prices Over $2,000/oz: Is Gold Too High? | The Gold Spot

76 -

25:04

25:04

Midas Gold Group

7 months agoReasons to Own Gold | The Gold Standard 2340

37 -

25:00

25:00

Midas Gold Group

1 year agoGuide to Investing in Gold (part 2) | The Gold Standard 2235

2681 -

4:49

4:49

Scottsdale Bullion & Coin

11 months agoMarket Complacency: The Unseen Advantage for #Gold & #Silver Buyers | The Gold Spot

34 -

32:07

32:07

The Market Sniper

9 months agoUnveiling the Truth: How Rising Rates Affect Gold & Silver Markets

842 -

25:10

25:10

Midas Gold Group

1 month agoWhy are Gold & Silver Going Up? | The Gold Standard 2415

123