More About "Exploring Different Types of Investment Vehicles for Your Retirement Savings"

https://rebrand.ly/Goldco1

Join Now

More About "Exploring Different Types of Investment Vehicles for Your Retirement Savings", retirement savings investment plan

Goldco helps customers safeguard their retired life cost savings by rolling over their existing IRA, 401(k), 403(b) or various other competent retirement account to a Gold IRA. ... To find out exactly how safe house precious metals can help you build as well as safeguard your wealth, and also even safeguard your retired life phone call today retirement savings investment plan.

Goldco is one of the premier Precious Metals IRA business in the United States. Secure your wide range and income with physical rare-earth elements like gold ...retirement savings investment plan.

Looking into Different Types of Investment Vehicles for Your Retirement Savings

When it comes to organizing for retirement, one of the very most vital points to consider is how to save and put in your hard-earned cash. There are actually several assets autos accessible in the market, each along with its personal collection of advantages and downsides. In this message, we will certainly discover various types of expenditure motor vehicles that may help you increase your retirement life savings.

1. Individual Retirement Accounts (IRAs): IRAs are a preferred choice for retirement cost savings because they provide tax obligation advantages. There are two principal types of IRAs: typical and Roth. Along with a traditional IRA, contributions may be tax-deductible, and income taxes are postponed until you withdraw the money during retirement life. On the various other hand, Roth IRAs provide tax-free withdrawals in retirement life but payments are not tax-deductible.

2. 401(k) Strategy: 401(k) program are employer-sponsored retired life accounts that allow employees to add a portion of their salary on a pre-tax basis. Some employers additionally match a portion of worker contributions, which can easily considerably boost your savings over opportunity.

3. Sells: Investing in stocks enables you to come to be a partial proprietor in business and profit coming from their growth over opportunity. While stocks possess the possibility for high yields, they also happen with higher dangers reviewed to other expenditure options.

4. Connections: Connections are fixed-income safeties where an entrepreneur gives loan to an body (such as a authorities or firm) in substitution for routine interest payments over a specified duration of time. Bonds normally hold lesser risks reviewed to sells but might supply reduced yields as properly.

5. Mutual Funds: Reciprocal funds merge funds coming from numerous capitalists to spend in a variety of assets such as inventories, bonds, or both. They deliver variation benefits by dispersing investments around different securities and asset classes.

6. Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock swaps like personal supplies. They give versatility, reduced costs, and make it possible for financiers to acquire visibility to a specific sector or mark.

7. Actual Estate Investment Trusts (REITs): REITs enable investors to possess and make money coming from actual property without the demand for direct residential or commercial property ownership. They deliver frequent income by means of rental remittances and may be a great choice for diversifying your profile.

8. Pensions: Pensions are insurance coverage contracts that give a ensured revenue flow in retirement. They may be either instant or deferred, relying on when you start acquiring payments.

9. Certificate of Deposit (CD): CDs are time down payments used by banks with taken care of rate of interest rates and maturity time. They are thought about low-risk financial investments but commonly use lower gains compared to other investment choices.

10. Health Savings Accounts (HSAs): While predominantly created for healthcare expenses, HSAs can easily also provide as retirement cost savings automobiles. Additions are tax-deductible, earnings grow tax-free, and drawbacks for qualified medical expenditures are tax-free as effectively.

It's essential to note that these investment vehicles come along with their very own collection of threats and rewards. It's crucial to evaluate your threat resistance, monetary targets, and time perspective prior to making any type of investment selections.

In verdict, there are actually several styles of financial inve...

-

6:20

6:20

Website with WordPress

9 months agoExamine This Report on "Retirement Investing Demystified: How to Make the Right Choices"

31 -

5:22

5:22

Website with WordPress

11 months ago"5 retirement investing options you need to know" Things To Know Before You Get This

15 -

6:05

6:05

Website with WordPress

1 year agoA Biased View of "5 retirement savings investment plans you need to know about"

10 -

5:10

5:10

Website with WordPress

1 year agoThe Main Principles Of "5 Retirement Savings Investments You Should Consider"

6 -

7:14

7:14

Website with WordPress

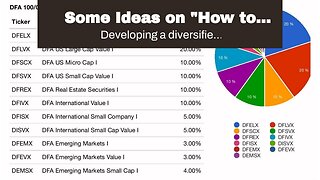

11 months agoSome Ideas on "How to Create a Diversified Retirement Portfolio with Multiple Investment Plans"...

42 -

4:57

4:57

Website with WordPress

10 months agoUnknown Facts About "Why a Retirement Savings Investment Plan is Essential for Financial Indepe...

15 -

7:04

7:04

Website with WordPress

11 months agoSome Known Details About "How to Balance Risk and Reward in Your Retirement Savings Investments...

11 -

28:59

28:59

Investor Guys Podcast

3 years ago $0.02 earnedInvesting For Retirement

339 -

7:27

7:27

Website with WordPress

1 year ago6 Easy Facts About "Why Diversification is Key to a Successful Retirement Savings Strategy" Exp...

23 -

6:18

6:18

Website with WordPress

1 year ago"Why Diversification is Essential in Retirement Investing" Fundamentals Explained

8