Not known Incorrect Statements About "Gold as a Safe Haven Investment: Protecting Your Wealth i...

https://rebrand.ly/Goldco1

Sign up Now

Not known Incorrect Statements About "Gold as a Safe Haven Investment: Protecting Your Wealth in Uncertain Times" , to invest in gold

Goldco aids clients shield their retired life savings by surrendering their existing IRA, 401(k), 403(b) or various other certified retirement account to a Gold IRA. ... To discover just how safe haven precious metals can aid you construct and shield your wealth, as well as even secure your retirement telephone call today to invest in gold.

Goldco is one of the premier Precious Metals IRA firms in the United States. Secure your wide range as well as resources with physical rare-earth elements like gold ...to invest in gold.

Understanding the Historical Performance of Gold: A Appeal at its Long-Term Returns

Gold has been a highly valued and sought-after priceless steel for centuries. Its allure exists not merely in its particular elegance but also in its capability to provide as a safe place financial investment in the course of opportunities of economic anxiety. Capitalists have long switched to gold as a establishment of worth, specifically during the course of time frames of inflation or when various other possession courses are underperforming. In this blog blog post, we will explore the historical efficiency of gold and take a look at its long-term profits.

To truly recognize the historical performance of gold, it is essential to take a action back and look at its cost movements over an extended period. Unlike various other properties such as stocks or connections, gold does not create any cash money circulation or rewards. Its market value is exclusively found out by source and demand mechanics in the market.

Over the past century, gold has experienced substantial rate fluctuations. It arrived at an all-time high in 1980 when it traded at around $850 per ounce due to geopolitical pressures and higher inflation prices. However, through 2001, the price had lost to around $270 every ounce due to boosted financial health conditions and reduced inflation fees.

Since at that point, gold has been on an up path with occasional dips along the way. The worldwide economic problems in 2008 saw financiers crowding to gold as a safe shelter asset, steering costs up to new highs. Through September 2011, gold hit a record high of over $1,900 every ounce.

In latest years, gold costs have remained pretty stable but have seen some volatility in the middle of international economic unpredictabilities such as field battles and political irregularity. As of [present year], gold is trading around [present price] every oz.

Now permit's dig into the long-term returns delivered through committing in gold. Over prolonged time frames such as years or also centuries, examining annualized returns can provide valuable insights into how an possession has executed over time.

According to information coming from [trustworthy resource], the ordinary annualized return for gold over the past times [variety of years] is around [x%]. Of course, it is important to take note that previous efficiency does not guarantee future outcome, and gold prices may be influenced by a large variety of factors.

One crucial factor that influences the performance of gold is rising cost of living. Traditionally, gold has provided as a bush against inflation. When inflation rates climb, the acquisition energy of fiat money decreases, inducing entrepreneurs to find substitute stores of value such as gold. This increased need can drive up the cost of gold and lead in beneficial profits.

An additional factor that affects gold costs is capitalist belief. Throughout times of financial uncertainty or market volatility, real estate investors frequently switch to safe sanctuary possessions like gold. This increased demand can lead to higher costs and potential yields for those keeping onto their gold financial investments.

It's likewise worth keeping in mind that geopolitical stress can easily possess a significant impact on the cost of gold. Throughout time frames of political weakness or disagreements, capitalists tend to crowd towards safe shelter properties such as gold, which can easily drive up its market value.

While committing in bodily gold via clubs or pieces stays a well-known alternative for many clients, there are likewise various other opportunities on call for getting visibility to this valuable metal. Exchange-traded funds (ETFs) and mutual fun...

-

9:32

9:32

China Uncensored

12 hours agoBad Things Are Happening In Taiwan...

16.9K16 -

38:24

38:24

Tucker Carlson

10 hours agoTucker Carlson and Donald Trump Jr. Respond to the Trump Verdict

95.6K499 -

2:01:47

2:01:47

Fresh and Fit

10 hours agoOne Hit Wonder 🤡 Kicked Off For THIS...

171K362 -

34:19

34:19

Alexis Wilkins

16 hours agoBetween the Headlines with Alexis Wilkins: The Verdict and More

45.5K30 -

1:11:21

1:11:21

Kim Iversen

16 hours agoWW3?!? Is The West Secretly Behind Another Color Revolution Aimed At Toppling Russia? | Biden Maniacally Bombs Yemen and Russia

90.9K86 -

1:36:46

1:36:46

Roseanne Barr

14 hours agoFor Love of Country with Tulsi Gabbard | The Roseanne Barr Podcast #50

100K169 -

33:59

33:59

TudorDixon

21 hours agoA Story of Sacrifice and Service with Joe Kent | The Tudor Dixon Podcast

37K4 -

27:22

27:22

The Nima Yamini Show

13 hours agoAlpha Nima Crushes Nick Fuentes & Business Tips with Dylan

35K20 -

1:19:23

1:19:23

Mally_Mouse

12 hours agoLet's Hang - Cosplay Stream!!

52.7K2 -

1:05:06

1:05:06

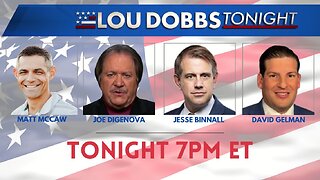

Lou Dobbs

18 hours agoLou Dobbs Tonight 5-31-2024

68.4K42