About "Balancing Risk and Reward in Retirement Investing: Strategies to Safeguard Your Savings"

https://rebrand.ly/Goldco3

Sign up Now

About "Balancing Risk and Reward in Retirement Investing: Strategies to Safeguard Your Savings", retirement investing basics

Goldco assists clients secure their retired life savings by rolling over their existing IRA, 401(k), 403(b) or other certified retirement account to a Gold IRA. ... To discover how safe house precious metals can help you construct and also protect your wealth, and also also protect your retired life telephone call today retirement investing basics.

Goldco is one of the premier Precious Metals IRA companies in the United States. Secure your riches and also source of income with physical rare-earth elements like gold ...retirement investing basics.

Investing in Real Estate for a Comfortable Retirement: Pros and Downsides

Actual property has long been looked at a prominent expenditure possibility, specifically for those looking to secure a comfortable retired life. Along with its possibility for long-term gratitude and the possibility to create easy revenue, spending in actual real estate can easily give people along with a reputable source of funds throughout their gold years. Nevertheless, like any kind of expenditure tactic, there are pros and drawbacks to think about just before diving into the world of real property.

Pros of Investing in Real Estate for Retirement:

1. Potential for Recognition: One of the greatest perks of committing in real real estate is its ability for long-term recognition. Historically, actual property values tend to increase over opportunity, permitting real estate investors to develop equity and potentially sell their properties at a revenue eventually on. This recognition may significantly contribute to a senior's financial well-being.

2. Passive Income Generation: An additional conveniences is the ability to create passive income with rental homes or genuine estate financial investment leaves (REITs). By having rental properties, retirees can easily receive regular monthly rental remittances that can muscle building supplement their retirement cost savings or deal with living expenses. REITs offer an extra method for easy earnings as they disperse incomes coming from rent or property purchases among shareholders.

3. Diversity: Investing in actual real estate makes it possible for retirees to branch out their expenditure collection beyond traditional stocks and connections. This variation minimizes risk through spreading out investments across different resource classes that may not be directly connected with each other. Genuine property's low correlation with various other expenditures implies it may function as a hedge versus market dryness.

4. Inflation Hedge: Actual property expenditures have traditionally acted as an rising cost of living hedge due to rental profit enhancing along along with inflation costs over opportunity. As costs rise, thus also do rental payments, offering capitalists along with boosted cash circulation that maintains pace along with the price of living.

5. Positive Asset: Unlike supplies or connects that exist exclusively on newspaper or digital systems, real real estate is concrete - you can find and touch it. This tangibility can offer senior citizens with a feeling of surveillance, knowing that their assets is actually present and not subject to the very same market variations as abstract resources.

Cons of Investing in Real Estate for Retirement:

1. High Initial Costs: Investing in actual property usually calls for a notable quantity of funds upfront. Obtaining residential properties, performing remodellings or repair services, and dealing with on-going upkeep expenses can be expensive. For retirees on fixed incomes or limited savings, these high preliminary costs might present a obstacle to access.

2. Illiquidity: Unlike stocks or bonds that may be easily purchased or sold on economic markets, real estate is pretty illiquid. It takes time to discover customers and complete deals, which may restrict retired people' potential to promptly access their assets funds if needed.

3. Monitoring Accountabilities: Having rental residential or commercial properties comes with monitoring obligations such as finding lessees, gathering rent repayments, handling repair work and upkeep, and dealing along with prospective legal concerns. These accountabilities need opportunity and effort, which may not be viable for retired people looking for a hassle-free retired lif...

-

5:10

5:10

Website with WordPress

11 months agoThe Main Principles Of "5 Retirement Savings Investments You Should Consider"

5 -

6:45

6:45

Website with WordPress

11 months agoThe 15-Second Trick For "Understanding Risk and Reward in Retirement Investing"

16 -

6:28

6:28

Website with WordPress

1 year agoThe Basic Principles Of "Why Diversification is Essential in Retirement Investing"

7 -

7:14

7:14

Website with WordPress

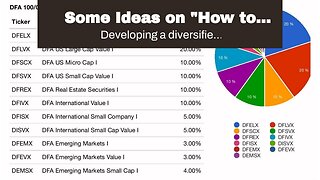

11 months agoSome Ideas on "How to Create a Diversified Retirement Portfolio with Multiple Investment Plans"...

42 -

8:28

8:28

Website with WordPress

1 year ago"5 Retirement Savings Investment Plans to Secure Your Golden Years" Fundamentals Explained

3.1K3 -

7:01

7:01

Website with WordPress

1 year agoNot known Facts About "Understanding Risk Tolerance in Retirement Investing"

37 -

7:27

7:27

Website with WordPress

1 year ago6 Easy Facts About "Why Diversification is Key to a Successful Retirement Savings Strategy" Exp...

23 -

1:05

1:05

DigitalCreative

8 months agoEnhance retirement savings

4 -

6:05

6:05

Website with WordPress

1 year agoA Biased View of "5 retirement savings investment plans you need to know about"

10 -

6:20

6:20

Website with WordPress

1 year agoThe Only Guide to "How to Determine Your Risk Tolerance for Retirement Investing"

3