2024's Economic MELTDOWN - Worst Since the Great Depression?!

In today's eye-opening video, we delve into a potentially catastrophic economic crisis that's making headlines – a crisis not seen since the Great Depression. 📉 Could 2024 be the year that changes everything?

If you're concerned about your financial future, you need to watch this.

📊 Fox Business Reports:

Recent data suggests that if the White House and Congress fail to take action by cutting inflation-causing government spending, the consequences could be nothing short of disastrous. What's at stake? Let's unravel the story together.

🔍 Examining the Data:

As we navigate through this narrative, we uncover an alarming trend. Unprecedented levels of money creation have been spurred by Federal Reserve policies, which have, in turn, encouraged Congress to spend recklessly and maintain extremely low interest rates. But warnings about potential future inflation have fallen on deaf ears.

🤔 Remember the Stimulus Checks?

Back during the height of the pandemic, we all received those stimulus checks, right? It made us ponder, "Is this how inflation starts – by increasing the money supply?" And indeed, that's the case. Inflation begins when the money supply surges. We questioned the sustainability of such measures, as prices remained relatively stable at the time.

📈 The Inflation Debate:

We recall the voices of individuals like Jerome Powell and Janet Yellen assuring us that inflation was merely transitory. Their message was simple: "Once everyone returns to work, it will all balance out." But what actually transpired was a far cry from their predictions.

💸 Spiraling Inflation:

Instead of returning to normal levels of spending, the White House and Congressional Democrats, with the Fed's approval, continued to allocate vast sums to government expenditures. Coupled with low interest rates and external factors like the Ukraine crisis, inflation skyrocketed to levels unseen in four decades. From eggs to milk to gas, prices have gone through the roof, affecting us all.

💡 Impact on Families:

The effects of this inflation crisis are widespread. Families now find themselves juggling student loan payments in the midst of spiraling inflation. With average loan payments ranging from $100 to $300, what used to cover a month's groceries now barely stretches a week. Tough choices lie ahead for many.

💰 The Strain on Savings:

Savings are dwindling, and financial institutions confirm it. Checking, savings, money market accounts – they're all taking a hit. Why? Because everyday items have become more expensive. Inflation is running rampant, and until a solution is found, consumers worldwide will continue to feel the pinch.

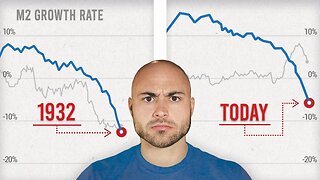

📉 Parallels to the Great Depression:

The shocking reality is that the rate of money supply decline is reminiscent of the 1930s during the Great Depression. Yet, unlike that era, prices today are still on the rise. This unprecedented situation signals a looming crisis.

🔥 Inflation's Toll:

The Fed's policies and the Biden administration's inflationary spending have left American families in dire straits. People are dipping into their savings and accumulating debt just to cover the basics – food, utilities, and housing.

💳 Credit Card Debt Surge:

Contrary to what some may believe, the soaring levels of credit card spending aren't a sign of economic prosperity. Instead, they're a manifestation of growing frustration. In fact, collectively, credit card debt has crossed the trillion-dollar mark for the first time. People are resorting to debt due to rampant inflation.

❓ What's the Solution?

While the solution remains elusive, this article hints at excessive government spending under the Biden administration as a key factor. Can we reverse this course, or is a crash inevitable?

📈 Market Insights:

We also take a close look at the S&P 500 outlier data, a valuable AI trading resource. The recent sell signal from September 18th remains in play, raising concerns about a potential market crash. Stay informed with an account at ovtlyr.com to track these market developments.

🗣️ Join the Conversation:

Many voices have called out the potential economic crisis. Some may dismiss the warnings, citing previous predictions that did not materialize. But this time, the situation seems different.

💡 Your Takeaway:

In conclusion, we are facing a grave threat in the form of inflation and a potential economic crisis. The circumstances we find ourselves in haven't been seen since the Great Depression of 1929. Could history repeat itself in 2024?

Stay informed, stay prepared, and let's navigate this economic landscape together. If you found this video insightful, please like, share, and subscribe for more updates on this critical topic. Your financial future may depend on it!

#EconomicCrisis #Inflation #GreatDepression #FinancialCrisis #MarketInsights #FoxBusiness #FinancialNews #EconomicPredictions

-

43:39

43:39

The Truth Central

8 months agoWhy We're Not Ready for an Economic Worst-Case Scenario

308 -

0:34

0:34

Wealthion

11 months agoWe Can't Deny This Screaming Recession

38 -

19:09

19:09

Heresy Financial

1 year agoThis Hasn't Happened Since the Great Depression

844 -

0:23

0:23

Wealthion

1 year ago $0.01 earnedThe Worst Asset Bubble in History?

138 -

5:43

5:43

Figuring Out Money

4 years ago $0.01 earnedThe 2020 Recession: 7 Things I'm Doing to Prepare for the For The Next Economic Crash

43 -

0:50

0:50

Wealthion

9 months agoWhat's Messing Up The Economy?

83 -

0:46

0:46

Wealthion

11 months ago $0.01 earnedThe Worst Times Of Our Economy

161 -

1:50:05

1:50:05

BossBlunts

2 years agoThe Economy is going to collapse & we're gonna get rich... Just don't dance.

90 -

57:43

57:43

Wealthion Videos

1 year ago $0.01 earned'It Gets Ugly' Fast If A Deflation Overshoot Leads To Big Layoffs | Michael Every

1902 -

9:08

9:08

SRU

1 year ago $0.02 earnedEconomic Crisis? Waves Of Mass Layoffs? Stagflation? Starvation? Experts Say All This & More In 2023

1031