The Failed Bounce Trading Strategy

Sign in

Find Your Fun

hero-wars.com

Sponsored ·

1:58

4

0:01 / 1:59

The Failed Bounce Trading Strategy

Quantified Strategies

6.43K subscribers

650 views Premiered Mar 15, 2023 TRADING STRATEGIES - PLAYLIST

The Failed Bounce Trading Strategy

Do not forget to become a member and join our community on our website.

Welcome to our video about the Failed Bounce trading strategy. This strategy was published on our website eight years ago and has proven to be a successful trading approach. Despite the unusual name, the strategy has produced solid results, which we will explain in this video.

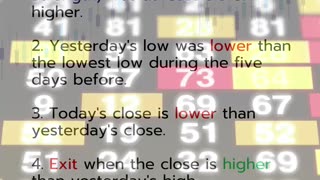

The Failed Bounce strategy involves buying on short-term pullbacks and selling on strength. It has worked well on stocks since the late 1980s, returning an average of 0.86% per trade. Out of the 204 trades, 77% turned out to be winners, resulting in a net profit of 450%. Despite being invested only 8.5% of the time, the annual return is 5.8%. This equals a risk-adjusted return of 67%, which is impressive.

In the video, we show examples of three trades - two winners and one loser - and explain the strategy's trading rules. We also discuss the importance of the IBS indicator, which we believe is the most underrated indicator in trading.

The strategy works well on stocks but not on commodities or bonds. We have tested the strategy on other ETFs and futures, and it has been successful. The equity curve on the left shows Pepsi-Cola since 1976, and the curve on the right tracks consumer staples. The best results have been achieved with QQQ, which has an average of 1% per trade.

If you want to know the code we used for this strategy, you can find it on our website, where we have hundreds of strategies for all asset classes. All of our strategies are coded and backtested.

In conclusion, the Failed Bounce strategy is a successful trading approach that has produced impressive results. We hope you found this video helpful and informative. Don't forget to subscribe to our channel for more trading insights and updates. Good luck trading!

#tradingstrategy #stockmarket #investing #failedbounce #IBSindicator #backtesting #riskadjustedreturns #stocks #ETFs #futures #tradingtips #tradinginsights

You can read more about it here:

https://www.quantifiedstrategies.com/...

TWITTER

https://bit.ly/Twitter_QS

INSTAGRAM

https://bit.ly/Instagram_QS

NEWSLETTER - QUANTIFIED STRATEGIES

30 000+ Traders read our free newsletter about trading strategies.

Sign up: https://bit.ly/substack_QS

RISK DISCLAIMER

Quantified Strategies (SIA Lofjord) is not an investment advisor. The content and information provided are educational and should not be treated as financial advisory services or investment advice. Trading and investment in securities involve substantial risk of loss and is not recommended for anyone that is not a trained trader or investor – it shall be conducted at your own risk. It is recommended that you never risk more than you are willing to lose. Leverage can lead to substantial losses. Any use of leverage, margin, or shorting is at your discretion. Quantified Strategies (SIA Lofjord) is not responsible for any losses that occur as a result of its content and information.

Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, Since the trades have not been executed, the results may have under or overcompensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representations are made that any account will or is likely to achieve profit or losses similar to those shown.

-

1:49

1:49

quantifiedstrategies

1 year agoThe Failed Bounce Trading Strategy

-

0:34

0:34

quantifiedstrategies

3 months agoStocks Go Up When the Failed Bounce Strategy Does This

641 -

0:51

0:51

Top Dog Trading

7 months agoBreakout Trading Strategy

-

0:37

0:37

Learn to Trade with Joseph James

11 months agoWhere Should You BUY Low for Profitable Trades..? 💵

10 -

0:35

0:35

Learn to Trade with Joseph James

1 year agoHow to BUY into a Pullback.. Trading Strategy 💰

5 -

6:09

6:09

Trading_Soldier

1 month agoTrading Data in your Trading Strategy - Is It a Blessing or a Curse?

38 -

0:47

0:47

Learn to Trade with Joseph James

7 months agoTrade Smarter: BEAR Market Breakout Pullbacks Strategies...💸

-

0:28

0:28

Learn to Trade with Joseph James

7 months agoTop 2 Profitable Trading Strategies | Trading Tips & Tricks💰

-

0:54

0:54

Learn to Trade with Joseph James

11 months agoAre you Struggling with LOSSES in Trading..? 💸

6 -

0:55

0:55

Learn to Trade with Joseph James

7 months agoPattern Trading Mastery: The Two-Try Failure Approach.. 💰

4