THE FINAL FINANCIAL MELTDOWN?

August 21, 2011

Heavy losses are showing up on the stock market exchanges around the world during the last two weeks while the price of gold has been steadily rising every day to record highs. The commodity markets are very unstable, the price of oil is down from its high of $100 plus per barrel and the U.S. dollar is down again this week.

I am going to show you that financial crashes are induced by the World Government, which exercises total control of global and national banking, sales of commodities and the setting of currency exchange rates. All banking and other financial corporations are controlled by this World Government.

There is a history of crashing the economy in the United States, resulting in economic depression, recession, unemployment, bankruptcy of businesses and starvation for the poor.

In the early years, the World Government wanted the United States to have a central bank that they could control but the American people didn’t want a central bank like in Europe, because they had seen enough of the Rothschild’s manipulation. The World Government declared war on the American people and created ten panics that brought the American economy into shambles.

1. THE PANIC OF 1819

2. PANIC AND DEPRESSION OF 1832

3. PANIC AND DEPRESSION OF 1836

4. THE PANIC OF 1837, CAUSING A SIX YEAR DEPRESSION UNTIL 1843

5. THE PANIC OF 1857

6. PANIC AND DEPRESSION FROM 1869-1871

7. THE PANIC OF 1873

8. THE PANIC OF 1893

9. THE PANIC OF 1901

10. THE PANIC OF 1907

It took the World Government and its puppets, the bankers, ten economic crashes to force the American people to accept a central banking system controlled by the Bank of England, which in turn was controlled by the Rothschild banking house. The Federal Reserve Act passed on December 1913. The result was that most independent farm and city banks were either crushed or bought up by the big New York banking houses.

THE FINAL PUSH FOR GLOBAL CONTROL

Up to 1913 each nation controlled most of its own economic development but this had to be destroyed in order to create a global economy. It was done in a series of staged crashes:

The stock market crash in 1917 as the U.S. was dragged into WWI. The downturn lasted 393 days and the market lost 40.1% of its value.

The stock market crisis in 1919. The downturn lasted 660 days and the market lost 46.6% of its value.

The stock market crash of 1929. The downturn lasted only 71 days, but the market lost 47.9% of its value.

THE DEATH BLOW CAME IN 1930

We have been told that the Great Depression began in 1929 but it really began on April 17, 1930. It would last 813 days and investors lost 86% of their investments. The stock market made a partial comeback by July, 1932, but the deep worldwide depression didn’t end until WWII began.

THE STOCK MARKET CRASH IN 1937

Scandals on Wall Street and the ongoing severe depression were the reasons given as to why the stock market crashed on April 10, 1937. The market was down for 386 days and did not move upward until March 31, 1938. The market lost 49.1% of its value.

THE STOCK MARKET CRASH OF 1939

Germany had been re-arming since 1936, and when they attacked Poland on September 1, 1939, the New York Stock Market crashed eleven days later. The market was depressed until April 28, 1942. The international bankers and investment houses purchased the sold off stocks, knowing full well that the military build-up in the United States would boost the profit on stocks more than 500%. The investors who sold off their stocks lost 40.4% and the market was suppressed for 959 days.

THE STOCK MARKET CRASH OF 1973

The war in Vietnam was winding down and taking down the defense industry. The Watergate scandal took place on June 17, 1972, when former intelligence agents working for President Nixon broke into the National Democratic Headquarters to steal secret documents regarding the coming election campaign. The market crashed on January 11, 1973 and stayed suppressed for 694 days when it started to recover on December 6, 1974. Investors’ losses amounted to 45.1%

THE STOCK MARKET CRASH IN 2000

The crash in 2000 was the year that the tech bubble burst from Internet companies who had been riding high and driving up the financial markets. It began on January 15, 2000 and the downturn lasted for 999 days and ended on October 9, 2002. Investment losses at this crash were 37.8%. During this period the 9/11 attack on the twin towers took place in 2001 and caused the United States to invade Afghanistan on October 7, 2001. With this war and the eventual war in Iraq, the U.S. again built up its war machine and money was made at Wall Street.

THE CRASH AND PANIC OF 2008

The crash on September 16, 2008 was the result of the collapse of the American housing market, which began to decline in 2006. This was a typical Rothschild operation that began when banks started with low interest rates on so-called introductory rates, which would last for five years, and then the mortgage rate would rise to a very high rate. Since this was the age of re-financing, lenders would offer loans to people who did not qualify for a high mortgage rate, but could qualify for a low introductory rate. The lender would tell the borrower to refinance in five years and get a better mortgage rate. The problem was that the banks had loaned out too much money and sold subprime mortgages to raise more cash.

Read the Rest: https://eaec.org/desk/08-21-2011.pdf

Join us for our weekly webcast Sundays 9AM PST or anytime during the week at: https://eaec.org/webcast.htm

If you can support us that would be great. We are usually running on empty: https://eaec.org/donation.htm

-

38:24

38:24

Tucker Carlson

8 hours agoTucker Carlson and Donald Trump Jr. Respond to the Trump Verdict

65.9K363 -

2:01:47

2:01:47

Fresh and Fit

8 hours agoAfter Hours w/ & Tommy Sotomayor

148K295 -

34:19

34:19

Alexis Wilkins

14 hours agoBetween the Headlines with Alexis Wilkins: The Verdict and More

39.6K30 -

1:11:21

1:11:21

Kim Iversen

14 hours agoWW3?!? Is The West Secretly Behind Another Color Revolution Aimed At Toppling Russia? | Biden Maniacally Bombs Yemen and Russia

85.2K67 -

1:36:46

1:36:46

Roseanne Barr

12 hours agoFor Love of Country with Tulsi Gabbard | The Roseanne Barr Podcast #50

95.2K159 -

33:59

33:59

TudorDixon

19 hours agoA Story of Sacrifice and Service with Joe Kent | The Tudor Dixon Podcast

34.6K4 -

27:22

27:22

The Nima Yamini Show

11 hours agoAlpha Nima Crushes Nick Fuentes & Business Tips with Dylan

33.2K20 -

1:19:23

1:19:23

Mally_Mouse

10 hours agoLet's Hang - Cosplay Stream!!

51.3K2 -

1:05:06

1:05:06

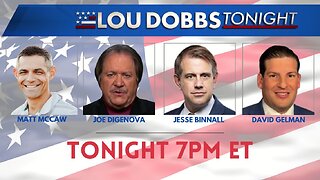

Lou Dobbs

17 hours agoLou Dobbs Tonight 5-31-2024

67.2K38 -

1:42:57

1:42:57

The Quartering

17 hours agoDonald Trump Conviction BACKFIRES, Massive Funds Raised, Democrats Swap Parties & More

103K99