Rule for 72nd Birthday | SECURE Act Overview Explained – Part 2/4

New Rule for 72nd Birthday – SECURE Act - RMDs can Wait

And you can keep contributing … Even Part-Time.

Good News, you can grow your retirement longer!

Want the Secure Act explained as simple as possible?

Get the Secure Act Roadmap: https://retirehappily.me/secure-act

Reference TITLE IV: Revenue Provisions, Section 401 of the SECURE Act signed December 20th, 2019

Why is this important?

We get some reprieve in taking money out of our retirement accounts, and if still working (even only part-time), we can still contribute longer.

1. Required Minimum Distribution (RMD) Age raised to 72

Section 113. Increase in Age for Required Beginning Date for Mandatory

Distributions Under current law, participants are generally required to begin taking distributions from their retirement plan at age 70 ½ . The policy behind this rule is to ensure that individuals spend their retirement savings during their lifetime and not use their retirement plans for estate planning purposes to transfer wealth to beneficiaries. However, the age of 70 ½ was first applied in the retirement plan context in the early 1960s and has never been adjusted to take into account increases in life expectancy. The bill increases the required minimum distribution age from 70 ½ to 72.

Good News!, you can wait nearly two more years to start taking the mandatory distributions from your IRA accounts, and if it is money you don’t need, you have two more years to do a partial Roth conversion to control your income tax cost. The 70½ rule began in the 1960s when life expectancy was shorter. This is likely the beginning of cascading changes coming in the near future as you will see in the Bonus Tip below.

2. Elimination of the 70 ½ Age Limit for Contributions

Section 106. Repeal of Maximum Age for Traditional IRA Contributions

The legislation repeals the prohibition on contributions to a traditional IRA by an individual who has attained age 70 ½ . As Americans live longer, an increasing number continues employment beyond the traditional retirement age.

This typically isn’t as big of a deal unless you are still working past 70 ½ . If you are working even part-time past 70 ½ you should still be able to contribute retirement savings account. If you plan to work beyond 70 ½ either by choice or necessity.

3. Part-Timers get to participate

Section 111. Allowing Long-term Part-time Workers to Participate in 401(k) Plans

Under current law, employers generally may exclude part-time employees (employees who work less than 1,000 hours per year) when providing a defined contribution plan to their employees. As women are more likely than men to work part-time, these rules can be quite harmful for women in preparing for retirement. Except in the case of collectively bargained plans, the bill will require employers maintaining a 401(k) plan to have a dual eligibility requirement under which an employee must complete either a one year of service requirement (with the 1,000-hour rule) or three consecutive years of service where the employee completes at least 500 hours of service. In the case of employees who are eligible solely by reason of the latter new rule, the employer may elect to exclude such employees from testing under the nondiscrimination and coverage rules, and from the application of the top-heavy rules.

This is a big deal for everyone. This opportunity nearly eliminates excuses for not squirreling away some of your income for the future.

As Promised …

What you need to know

We have a little more freedom in our required distributions and our opportunities to save while working.

How it may or may not affect you

This can be a great opportunity to save money on income taxes and add another level of income tax cost control.

What to ask your CPA, Attorney, or Financial Professional

Should you be putting more in your retirement accounts?

Should you be considering more converting more of your IRA to Roth to ease the tax burden?

How to know if you are doing it right.

Keep asking questions of someone you are comfortable is looking at the big picture AND all the little details of your plan.

More to Come …

George Wells

Ps. As always, when you have specific questions or need specific application insights, drop us a line. Life is too short to not –

Retire Happily!

Next: Show Me the Money! – from SECURE Act – part 3 of 4

https://retirehappily.net/show-me-the-money-from-secure-act-part-3-of-4/

Read this article on our website: https://retirehappily.net/rule-for-72nd-birthday-secure-act-part-2-of-4/

-

0:23

0:23

filtered

3 years ago $0.55 earnedRumble Account overview explained.

1.21K2 -

23:54

23:54

Bible Prophecy videos

3 years agoProphecy Explained Part 2 of 2

276 -

19:45

19:45

Bible Prophecy videos

3 years agoProphecy Explained Part 1 of 2

3802 -

57:16

57:16

Calculus Lectures

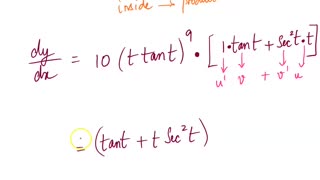

3 years agoMath4A Lecture Overview MAlbert CH3 | 6 Chain Rule

61 -

6:18

6:18

Astrologer & Psychic

3 years agoSaturn Square Uranus 2021 Part 1 - Overview

110 -

32:11

32:11

Microsoft Excel Full Course

3 years agoExcel 365 Part 1 - Overview Of The Interface

274 -

3:58

3:58

RetireHappily

3 years agoStretch Affect from SECURE Act | Is the stretch IRA dead? | Part 1/4

991 -

0:23

0:23

Fake news

3 years agoBirthday wishes

122 -

7:35

7:35

BrianEStead

3 years agoAlyssa's Birthday

271 -

2:16

2:16

BANG Showbiz EN

3 years ago $0.01 earnedQueen Elizabeth leads birthday tributes to Prince Charles on his 72nd birthday

44