Child tax credit payments: 2021 explained in ASL

Rough Transcript:

Hello and welcome! Remember my disclaimer? I am not a TAX expert but I am sharing what I believe I understand to the best of my ability. In July, IRS will be sending out money for Child tax credit and what’s that? In the past many of us that were eligible used this to REDUCE our taxes. Whatever was left would then be “nulled”. For example if I had $1,400 in taxes and child tax reduced it by 2,000(Old numbers, it’s now up to 3,000 or 3,600 if your child is under 6) I would end up owing NO taxes but we could not “claim” the 600 dollars difference. (2,000 Child credit minus Taxes owed 1,400 = 600 difference we couldn’t claim it. Darn.). They changed this and you CAN claim this now, EVEN IF YOU DO NOT OWE TAXES. Let me refer to the article now.

Details on exactly how frequently the checks would be distributed are not yet finalized, but here’s what we do know:

Child tax credits are not new, parents have previously received the benefits at tax-filing time.

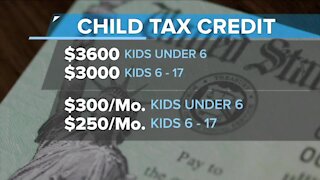

For this year only, Democrats have proposed increasing the benefit from $2,000 per child to $3,000 per child. Parents of children under age 6 would be eligible for an even larger $3,600 total credit.

The plan would also include $3,000 benefits to the parents of 17-year-olds who meet plan qualifications. Previously children had to be 16 or younger.

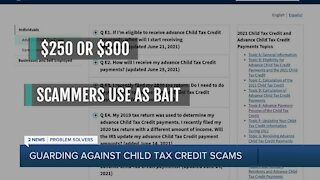

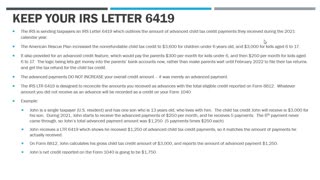

Regular check distribution would begin no sooner than July and would be an advance on up to half of the total benefit. So a family receiving the benefit for one child under the age of 6 would see $300 monthly payments for six months. Between 7 and 17, the benefit would be $250 monthly, if approved. Some math here- 6 months of July to December at 300 a month adds up to 1,800(which is half of your $3,600). 6 months of 250 a month would add up to $1,500. THEN at the end of the tax year when you do your files- IRS will credit you the difference of $1800 or $1500.

The added payments this year would begin phasing out for couples making over $150,000, and couples making over $170,000 would see no added benefit, according to the New York Times.

As in previous years, single filers making under $200,000 and married filers making less than $400,000 would still be eligible for the $2,000 payments.

The frequency of the checks containing the first half of the payment is not yet solidified. The Treasury Department will determine how frequently checks can realistically be distributed. Right now once a month for the next 6 months for Child Credit Tax is considered.

The remaining half of the credit would still be claimed when taxes are filed.

The credit would be refundable, meaning you could still get the credit even if you don’t end up owing taxes.

So, that’s the plan. We shall have to wait and see…

https://www.wpri.com/money/child-tax-credit-payments-what-we-know-about-the-plan-to-send-checks-to-parents/

https://www.facebook.com/ASLPB2020

https://www.facebook.com/ASLPatriotBroadcast/

https://www.facebook.com/DeafPatriot

MeWe link: https://mewe.com/join/aslpatriotbroadcast

Gab link: https://gab.com/ASLPatriotBroadcast

Rumble link: https://rumble.com/user/ASLPatriotBroadcast

YouTube link: YOU ARE KIDDING ME. NO MORE CENSTUBE.

Donations link to support: https://www.paypal.me/aslpatriotbroadcast

-

3:50

3:50

WXYZ

2 years agoChild Tax Credit Payments

1131 -

1:38

1:38

KJRH

2 years agoChild Tax Credit

68 -

3:56

3:56

Jason D Knott

2 years agoIRS Letter 6419 and the Child Tax Credit (Form 8812)

372 -

2:55

2:55

KERO

2 years agoIs the child tax credit working?

9 -

2:14

2:14

KJRH

2 years agoAdvance child tax credit help

36 -

2:48

2:48

WXYZ

3 years agoChild tax credit changes

87 -

2:26

2:26

WFTS

2 years agoUnderstanding the expanded child tax credit

58 -

7:08

7:08

Jason D Knott

2 years agoChild Care Tax Credits on IRS Form 2441

124 -

2:06

2:06

KJRH

2 years agoChild Tax Credit

4961 -

2:57

2:57

KMGH

2 years agoChild tax credit means monthly checks for many parents

451